* Growth of 83% that was posted in 2024 of K580 million with share value at 176% from 140.80% in 2024 and loan portfolio at over K4.4 billion from over K3.2 billion in 2024

* Despite the country’s economic challenges, Mudi managed to rectruit 5,936 new members in 2025 representing 54% of total target down from 2024’s 65% target

* First to hold members’ annual general meeting for the 3rd successive year — beating by far the deadline of April set by SACCO regulations

By Duncan Mlanjira

Being one of country’s leading Savings & Credit Cooperative (SACCO), Mudi SACCO is coming out visibly and evidently underscoring the fact that it is positively impacting on lives of scores of Malawians within its bond and beyond.

Advertisement

This is the profound statement of appreciation from Secretary to the Ministry of Industrialisation, Business, Trade & Tourism, Wiskes Mkombezi after Mudi SACCO announced at its annual general meeting (AGM) at Sunbird Mount Soche today, January 31, that it has posted a landmark surplus of K1.05 billion.

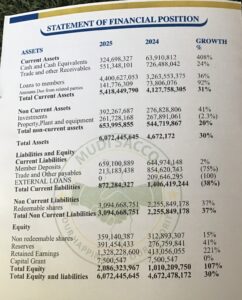

This is against over K580 million that was posted in 2024 representing a growth of 83% and Mudi SACCO, which commemorated its 35th Anniversary in the year under review, closed 2025 financial year with a share value at 176% from 140.80% in 2024 and a loan portfolio at over K4.4 billion from over K3.2 billion in 2024.

Among the highlights presented at the AGM by chairperson, Ronald Chilumpha, Mudi closed 2025 with 22,913 members and that despite the country’s economic challenges, the SACCO managed to rectruit 5,936 new members representing 54% of total target — down from 2024’s 65% target.

Of these new members, 24% were women and 7% the youth, and Chilumpha declared that going forward, Mudi will continue to enhance its growth strategy supported by all pillars in its 5-year strategic development plan “which is geared towards diversity, inclusivity and equity for all”.

The 2023-2027 strategic development plan, dubbed ‘Boeing M27:50:19’ has five pillars — Growth & Sustainability; Member-centric Service Culture; Outreach & Financial Inclusion; Governance & Human Resource Management; and Risk and Compliance Management.

Mudi was also applauded by Secretary Mkombezi for being compliant having taken note that it is the first SACCO to hold members’ AGM for the 3rd successive year — beating by far the deadline of April set by SACCO regulations.

Chilumpha further highlighted that 2025 was not favourable economically, however Mudi managed to increase its loan portfolio by 36%, member shares by 34%, total assets by 30% and earning the 83% surplus — while also managing to maintain delinquency ratio below 5% threshold at 1.67% and a loan portfolio of 72% to total assets.

Mudi SACCO has also increased its digital services and innovations by registering 41% of members on mobile banking with a plan to close 2026 with more than 80%. It has also introduced Debit Cards that can be used at all commercial banks, with First Capital Bank (FCB) being finalised.

Members are also informed of new developments through SMS alerts, which alert them whenever a transaction has been made on their accounts — thus Chilumpha that appealed to the customers to patronise Mudi’s digital platforms of Facebook, WhatsApp Chatbot, mobile banking platforms and Mthandizi toll free line 4307 “to avoid spending a lot on transportation costs and congesting the banking halls.

Mkombezi, who was guest of honour, thus profoundly applauded these innovations, emphasising that not only is Mudi SACCO improving people’s lives economically but every year through religiously hosting its AGMs, “member are able to express their minds in accordance with the way the business has been conducted in the previous year”.

He expressed his gratitude and the Ministry’s on the great improvement Mudi SACCO has achieved so far, saying: “It becomes our smile as it is with you to see SACCOs declaring dividends to their members.”

He commended the Board of Directors and management, led by Chief Executive Officer Triza Magreta, “for taking Mudi SACCO to greater heights”.

Going forward, Chilumpha, who retained his post as chairperson during the AGM’s election, declared that they plan to increase membership and to grow the loan portfolio in accordance with the 2023-2027 strategic development plan; to strengthen strategic alliances linkages and collaboration for diversity and inclusion.

They also plan to engage the digital capabilities and risk management; to capacitate human capital and to intensify member mobilisation.

He applauded the members, partners and all stakeholders that include Malawi Union of Savings and Credit Cooperatives (MUSCCO) and the Reserve Bank of Malawi (RBM) “for their unwavering support and contributions towards Mudi SACCO’s success. Our collective efforts and strategic focus have driven us this far — fostering innovations and positioning Mudi SACCO for success.”

The 35th Anniversary was celebrated under the theme; ‘35 Years of Impact: Reflecting on the Past, Shaping the Future’. Mudi SACCO head office is at Chichiri in Blantyre along Lali Lubani Road, opposite Chichiri Primary School, with branches at Kasinthula in Chikwawa, Nsanje, Zomba, Lilongwe, Mzuzu and a satellite centre in Mulanje.

Advertisement