* The 12-year period to conclude the appeal by Finance Bank of Malawi Limited voluntary liquidation is matter of serious concern

* Calls upon the President to expedite the appointment of the Judicial Service Commission and the Parliamentary Public Appointments Committee to appoint the Independent Complaints Commission of the Judiciary

By Duncan Mlanjira

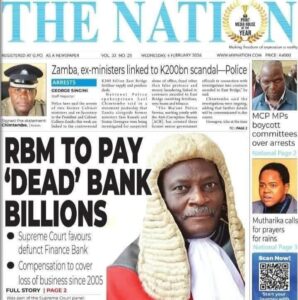

The Malawi Law Society (MLS) has faulted the Supreme Court of Appeal on the delayed pace of justice delivery citing the case of the appeal by Finance Bank of Malawi Limited voluntary liquidation filed in 2005 that was determined on February 3, 2026 — emphasising that this “is matter of serious concern”.

In a statement issued yesterday, February 11, 2026 by MLS chairperson, Davis Njobvu and honorary secretary, Francis Ekari M’mame, contends that the public reaction following Supreme Court of Appeal’s decision “presents an opportunity for reflection on the far-reaching impact of judicial decisions on litigants and the public at large”.

“Whilst the MLS acknowledges the ongoing efforts by the Judiciary to improve the pace of justice delivery in Malawi, a 12-year period to conclude an appeal is matter of serious concern.”

The MLS thus calls upon the State President to expedite the appointment of the Judicial Service Commission, and upon the Public Appointments Committee of Parliament to appoint the Independent Complaints Commissioner for the Independent Complaints Commission of the Judiciary (ICCJ).

“The MLS further urges the Government to support the operationalisation of the ICCJ. The MLS believes that the implementation of the Constitution (Amendment) Act, 2025 and the Judicial Service Administration Act, 2025 will significantly address systemic challenges, enhance accountability, provide avenues for public redress, and strengthen public confidence in the Judiciary.”

The MLS observes that the appeal following the ruling of the High Court’s commercial case No. 202 of 2008 that was filed by Finance Bank against the Reserve Bank of Malawi (RBM) and the Attorney General on behalf of the Minister of Finance set aside the judgment of the High Court, and allowed Finance Bank’s counterclaim.

Advertisement

The order declared that the suspension of Finance Bank’s foreign currency operations on or about May 17, 2005, and the revocation of its banking licence on or about May 18, 2005, “were undertaken in breach of the constitutional requirement of lawful and procedurally fair administrative action and were therefore unfair”.

The Supreme Court further ordered that damages, if any, be assessed by the Assistant Registrar, together with interest in accordance with Section 65 of the

Courts Act at the rate of 5%, or such other rate as may be prescribed, from the date of the accrual as determined upon assessment until payment in full, as well as costs in favour of Finance Bank.

“The declarations under paragraph 3 have generated considerable public and media interest. The MLS has received numerous requests to comment on and/or clarify the Supreme Court of Appeal’s judgment.”

Thus, in accordance with its statutory mandate under section 64(d) of the Legal Education and Legal Practitioners Act, to protect matters of public interest touching, ancillary or incidental to the law, the MLS has come forward to provide guidance to the public on certain aspects of the judgment.

The MLS further explains that it is unable to provide substantive commentary on the Court of Appeal’ decision at this stage, as the Court has not yet released its reasoned and perfected judgment, saying it will will provide further commentary, “if necessary, once the full judgment has been delivered”.

“Notwithstanding the absence of the reasoned and perfected full judgment, MLS considers it necessary to clarify the applicable procedure, available remedies to litigants before the High Court and the MSCA and the powers of the MSCA on appeal.

On the proceedings in the High Court, the MLS contends that “a party to litigation has the right to challenge a decision of the High Court by way of appeal if dissatisfied with the judgment of the High Court”.

“In civil matters, an appeal lies to the MSCA within six weeks where the decision appealed against is a final judgment of the High Court.

“In the present case, the High Court delivered a 59-paged judgment on October 27, 2014 in Commercial Case Number 202 of 2008: RBM v Finance Bank and (Finance Bank v the AG).

“The judgment contains extensive legal and factual analysis based on findings by the trial Judge. The decision was in favour of RBM. Subsequently, Finance Bank lodged an appeal challenging the High Court’s judgment.”

On the powers of the Court of Appeal in civil matters, the MLS observes that when when hearing an appeal from any judgment of the High Court in a civil matter, the Court of Appeal is vested with wide powers, indicating that under section 22 of the Supreme Court of Appeal Act, the Court may:

(a) confirm, vary, amend, or set aside the judgment or give such judgment as the case may require;

(b) if it considers it necessary or expedient in the interests of justice —

(i) order the production of any document, exhibit, or other item connected with the proceedings, the production of which appears to it necessary for the determination of the case;

(ii) order the attendance and examination of any witness who would have been a compellable at trial, whether or not such witness was called, or direct that such examination be conducted in accordance with the rules of Court;

(iii) receive evidence from any competent but non-compellable witness, including a party to the proceedings;

(iv) remit the case to the High Court for further hearing with appropriate directions;

(c) set aside the judgment and order a new trial where it considers it necessary; and

(d) may any other order as the interests of justice may require.

Advertisement

“Where the Court directs the taking of further evidence, it shall make such orders as are necessary to ensure that the parties are afforded an opportunity to examine every witness whose evidence is taken,” says the MLS, adding that the Supreme Court “also has the power to give any judgment or make any order that ought to have been made, including any order as to costs”.

“These powers may be exercised notwithstanding that the appellant seeks reversal or variation of only part of a decision, and may be exercised in favour of any party, whether or not such party has appealed.

On remedies of a party where a party is not satisfied with a decision of the Court of Appeal, the MLS maintains that the decision of the Appeals Court “is final and binding on all parties and all Courts below it” and that “determinations are made in accordance with the opinion of the majority of the justices of appeal hearing the appeal”.

“There is no right of appeal from a decision of the Court of Appeal. However, the Court may review its judgment in accordance with its own practice and the practice of the Court of Appeal in England.”

The MLS further observes that the High Court judgment addressed numerous factual issues and was based on evidence from six witnesses, five called by RBM and one by Finance Bank and that the trial judge upheld the actions of RBM and the Minister of Finance after a detailed evaluation of this evidence.

However, the Court of Appeal’s February 3 judgement “is only a minute order and does not contain an analysis of the grounds of appeal or the arguments advanced”. “Such analysis would ordinarily explain the legal reasoning underpinning the decision to set aside a comprehensive High Court judgment grounded in extensive factual and legal findings.”

Advertisement

The MLS also observes that the Supreme Court of Appeal’s order “does not award Finance Bank damages for loss of business profits, contrary to reports circulating on social media”, believing that the actual payments would be known after the assessment of damages.

Thus the MLS believes that there is an urgent need for the Court of Appeal “to expedite the delivery of its reasoned and perfected full judgment”, arguing that timely delivery would assist the public in understanding the basis of the Court’s decision and would help curb unfounded speculation and allegations directed at the Supreme Court.

“Given that the litigation commenced in 2008 in the High Court, the appeal, which was filed in 2016 was only disposed of in 2026, ten years after it was filed, the call for a prompt delivery of the perfected judgment is justified.

“Furthermore, RBM is a public institution. Similarly, the Ministry of Finance is a Government Ministry run on public funds. As such, any damages and costs payable will ultimately be borne by the public purse.”

Update on Tropical Cyclone Gezani