* Airtel Money customer growth up at 20%, bringing the total customer base to 49.8 million — driving digital adoption and strengthening the ecosystem to advance financial inclusion

* The Board has declared an interim dividend of 2.84 US cents per share, an increase of 9.2% in line with Airtel Africa’s progressive

* Our strategy has been focussed on providing a superior customer experience and the strength of these results is testament to the initiatives that we have been implementing across the business

By Duncan Mlanjira

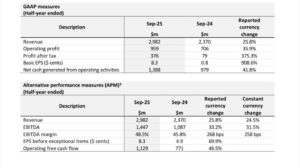

Airtel Africa has posted profit after tax of US$376 million improving from US$79m, representing a growth of 375.3% for half year ended September 30, 2025 — a strong performance which the company describes as deeply resonating with its ongoing success and strategic direction.

Advertisement

In its half year financial report, Airtel Africa registered a revenue growth of US$2,982 from US$2,370 in September 2024 (25.8%) while operating profit grew to US$959 from US$706 (35.9%).

The leading provider of telecommunications and mobile money services, with operations in 14 countries in sub-Saharan Africa further reports that its Airtel Money platform continues to be driving digital adoption and strengthening the ecosystem to advance financial inclusion.

“This is also evident in the acceleration in customer growth to 20%, bringing the total customer base to 49.8 million. Annualised total processed value (TPV) for Q2’26 surpassed US$193 billion (a 35.9% increase) — reflecting both the expanding customer base and a strong focus on enhancing engagement through ongoing innovation.

“These efforts contributed to an 11% increase in constant currency ARPU. The accelerating growth in our customer base across all segments underscores the success of our strategy which centres on the customer experience with the Airtel Spam alert — highlighting our approach to innovation, targeted capex maximising revenue generation and the expansion of digital offerings driving myAirtel app uptake.

Advertisement

“Our total customer base of 173.8 million increased 11.0%, with data customers of 78.1 million showing accelerated growth of 18.4%. Smartphone penetration increased another 3.8% to 46.8%, with data ARPU’s growing by 16.8% in constant currency — primarily reflecting the 45.0% increase in data traffic across the network.

“Our commitment to delivering a great customer experience is supported by ongoing investment in our network with the rollout of over 2,350 new sites to over 38,300 sites and an expansion of our fibre network by approximately 4,000kms to over 81,000kms.”

This investment, says the company, “continues to drive increased data capacity across the region as overall population coverage reached 81.5% — an increase of 0.7% from a year ago, with 98.5% of sites being 4G enabled”.

It further reports that currency appreciation in Q2’26 has seen reported currency revenue growth of 29.1% versus 24.2% growth in constant currency — which reflects the consistent execution of the company’s strategy, supported by tariff adjustments in Nigeria and continued strong growth momentum in Francophone Africa.

“Across the Group, mobile services revenue grew by 23.1% in constant currency, driven by voice revenue growth of 13.2% and data revenue growth of 37.0%. Data revenues of US$1,161 million has now surpassed voice as the biggest component of revenue for the Group.

“Mobile money revenues continue to benefit from its increased scale and higher levels of engagement to deliver a 30.2% growth in constant currency,” says the report, adding that EBITDA grew by 33.2% in reported currency to US$1,447 million with EBITDA margins expanding further to 48.5% from 45.8% in the prior period — driven by continued operating momentum and sustained benefits from our cost efficiency programme.

Meanwhile, the Airtel Africa Board has declared an interim dividend of 2.84 US cents per share, an increase of 9.2% in line with its progressive dividend policy — while the US$100 million share buy-back programme remains on track to complete on or before March 31, 2026.

Airtel Africa Chief Executive Officer, Sunil Taldar maintains that the company’s strategy has been focussed on providing a superior customer experience and the strength of these results is testament to the initiatives that it has been implementing across the business.

Sunil Taldar GCEO Airtel Africa Plc

“Digital innovation is a core focus, and we’re pleased to see the growing adoption of MyAirtel App as we seek to deepen customer engagement and simplify the customer journey,” he said. “Furthermore, our network continues to scale as we build additional capacity to facilitate the rise in both digital and financial inclusion.

“The increase in smartphone penetration to 46.8% reflects the substantial demand for data services across our markets but also highlights the scale of the opportunity to further develop the digital economy.

“Airtel Money continues to gain momentum, with our customer base nearing 50 million and annualised total processed value approaching US$200bn, up over 35% year-on-year. The acceleration in customer growth and continued growth in engagement on the platform reflects our success in driving digital adoption and innovation to enhance the ecosystem.”

Advertisement

Taldar further says the preparation for the IPO remains on course for a listing in the first half of 2026 and that the strength of their revenue performance — up 24.5% in constant currency – and further cost efficiency initiatives, has continued to support a further increase in EBITDA margins to 49% in Q2’26, and they will continue to focus on further incremental margin improvements, subject to macroeconomic stability.

“This strong performance gives us the confidence to increase our capex guidance for this financial year to between US$875 million and US$900 million, as we accelerate our investments to capture the full potential across our markets and deliver long-term value for all stakeholders.”

On its part, Airtel Malawi says the strong performance of the Group deeply resonates with their ongoing success and strategic direction: “Our local growth mirrors Airtel Africa’s emphasis on customer experience, digital innovation, and financial inclusion.

“Similarly, Airtel Money’s robust growth aligns with our mission to drive digital and financial inclusion across communities, empowering more Malawians to transact seamlessly,” says Airtel Malawi, who over the weekend were honoured with four accolades attained at 2025 Institute of Marketers in Malawi (IMM) Marketing Excellence Awards held over the weekend in Salima.

The Awards — which reflect the the leading mobile service provider’s ongoing efforts to deliver creative, strategic, and culturally relevant marketing that resonates with its customers — are:

* Outdoor Campaign of the Year (ChezaFaya Combo Bundles);

* Social Media Campaign of the Year (Airtel Top 8);

* Marketing Campaign of the Year – Brand (Airtel Top 8); and

* Marketer of the Year (Norah Chavula-Chirwa; who is Head of Brand & Communications, PR & CSR.

Advertisement