* Africa’s long-term growth trajectory will be determined by the continent’s ability to close its infrastructure gap

* Estimated at US$130 billion to US$170 billion annually, with a funding shortfall of up to US$108 billion—DCG’s Director of Project Finance, Loyiso Jiya

By Duncan Mlanjira

As South Africa and the continent as a whole is set to host the Group of Twenty (G20) Johannesburg 2025 summit from November 22-23; for the first time in its history, Don Consultancy Group (DCG) contends that Africa “stands at a critical juncture in unlocking its vast infrastructure potential, yet financing gaps and risk perceptions continue to constrain progress”.

DCG Director of Project Finance, Loyiso Jiya, maintains that “Africa’s long-term growth trajectory will be determined by the continent’s ability to close its infrastructure gap, estimated at US$130 to US$170 billion annually, with a funding shortfall of up to US$108 billion”.

DCG Director of Project Finance, Loyiso Jiya

He notes that this gap is not merely a challenge but a significant investment opportunity for global partners seeking sustainable returns in fast-growing markets.

“This requires a smarter blend of financing instruments, stronger project preparation frameworks, and deeper collaboration between public and private capital,” says Jiya, while underscoring that infrastructure remains the backbone of Africa’s industrialisation and economic integration — yet many projects fail to reach financial close due to weak structuring, poor feasibility assessments, and regulatory uncertainties.

“The opportunities in transport, energy, water, ICT, and social infrastructure are immense,” he adds, “but we must align financial innovation with governance reforms to ensure bankable and sustainable outcomes.

“Africa’s infrastructure growth is being propelled by five key opportunity areas. The continent is witnessing rapid progress in energy transition projects, especially in renewable energy investments such as solar, wind, and green hydrogen corridors.

Advertisement

“We are also seeing renewed momentum in transport corridors driven by regional integration under the AfCFTA, creating demand for cross-border rail, road, and port infrastructure.

“Meanwhile, the expansion of digital infrastructure — including broadband networks, data centers, and ICT backbones — continues to open new frontiers for investors,” says the Project Finance Director.

In addition, Jiya maintains that urban development “remains a major catalyst, as rapid urbanisation fuels the need for modern housing, sanitation, and urban transport systems” and that water and climate resilience projects “are drawing growing interest, supported by concessional and blended finance aimed at sustainable adaptation”.

“Together, these areas present Africa’s most bankable and transformative infrastructure opportunities for the next decade,” says Jiya, while cautioning that despite opportunities, “Africa faces persistent challenges in attracting long-term capital”.

“High political risk perception, limited project preparation capacity, currency volatility, and weak public-private coordination remain major bottlenecks. To unlock Africa’s full infrastructure potential, we must address the continent’s financing and risk constraints with deliberate, structured interventions.”

Jiya thus highlights some several strategic measures that DCG recommends to strengthen the environment for sustainable project financing, which include Africa first needing “to build robust project preparation pipelines by establishing dedicated facilities and feasibility funds that enhance bankability”.

“Second, we must expand blended finance mechanisms that combine concessional, commercial, and institutional capital to balance risk and return.

“Equally important is to enhance risk mitigation instruments, including guarantees, political risk insurance, and hedging tools provided by multilateral and regional development institutions.

“We must also promote well-structured Public-Private Partnerships (PPPs) by strengthening governance frameworks to boost investor confidence. Furthermore, local currency financing should be deepened to minimise foreign exchange exposure, and all projects must align with ESG and climate priorities to attract sustainable capital.

“These interventions are key to ensuring Africa’s infrastructure growth is both bankable and transformative,” says Jiya, while at the same time calling on the G20 summit “to play a catalytic role by expanding concessional funding, enhancing risk-mitigation tools, and supporting blended-finance models that crowd in institutional investors”.

Advertisement

“Strengthening the mandate and capitalisation of Multilateral Development Banks (MDBs), is central to unlocking private capital at scale,” says Jiya as he further calls for G20 summit support in accelerating the African Union’s Programme for Infrastructure Development in Africa (PIDA), “deepening project-preparation facilities, and aligning climate-finance commitments with Africa’s transition and adaptation needs”.

“Unlocking infrastructure financing is fundamental to Africa’s development and global economic stability. The G20’s partnership with Africa must shift from pledges to implementation, with instruments that make investment bankable, scalable, and sustainable.

“The future of Africa’s infrastructure financing lies in innovation, trust, and strong partnerships,” concludes Jiya.

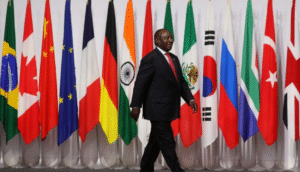

Host President Cyril Ramaphosa

The G20 summit is a gathering of heads of state and government, comprising 19 sovereign countries from the European Union (EU) and the African Union (AU), which works to address major issues related to the global economy as as international financial stability, climate change mitigation and sustainable development.

The G20 sovereign states — without its international members, like the EU or AU) account for around 85% of gross world product (GWP); 75% of international trade; 56% of the global population; and 60% of the world’s land area.

Including the EU and AU, the G20 — which was founded in 1999 in response to several world economic crises — comprises 78.9% of global population and 83.9% of global CO2 emissions from fossil energy.

Since 2008, the G20 has convened at least once a year, with summits involving each member’s head of government or state or finance minister or foreign minister and other high-ranking officials.

The AU joined as the 21st member at the 2023 summit in India and was officially represented at the 2024 summit in Brazil as part of the group’s stature that has risen during the subsequent decade, and is recognised by analysts as exercising considerable global influence.

Advertisement