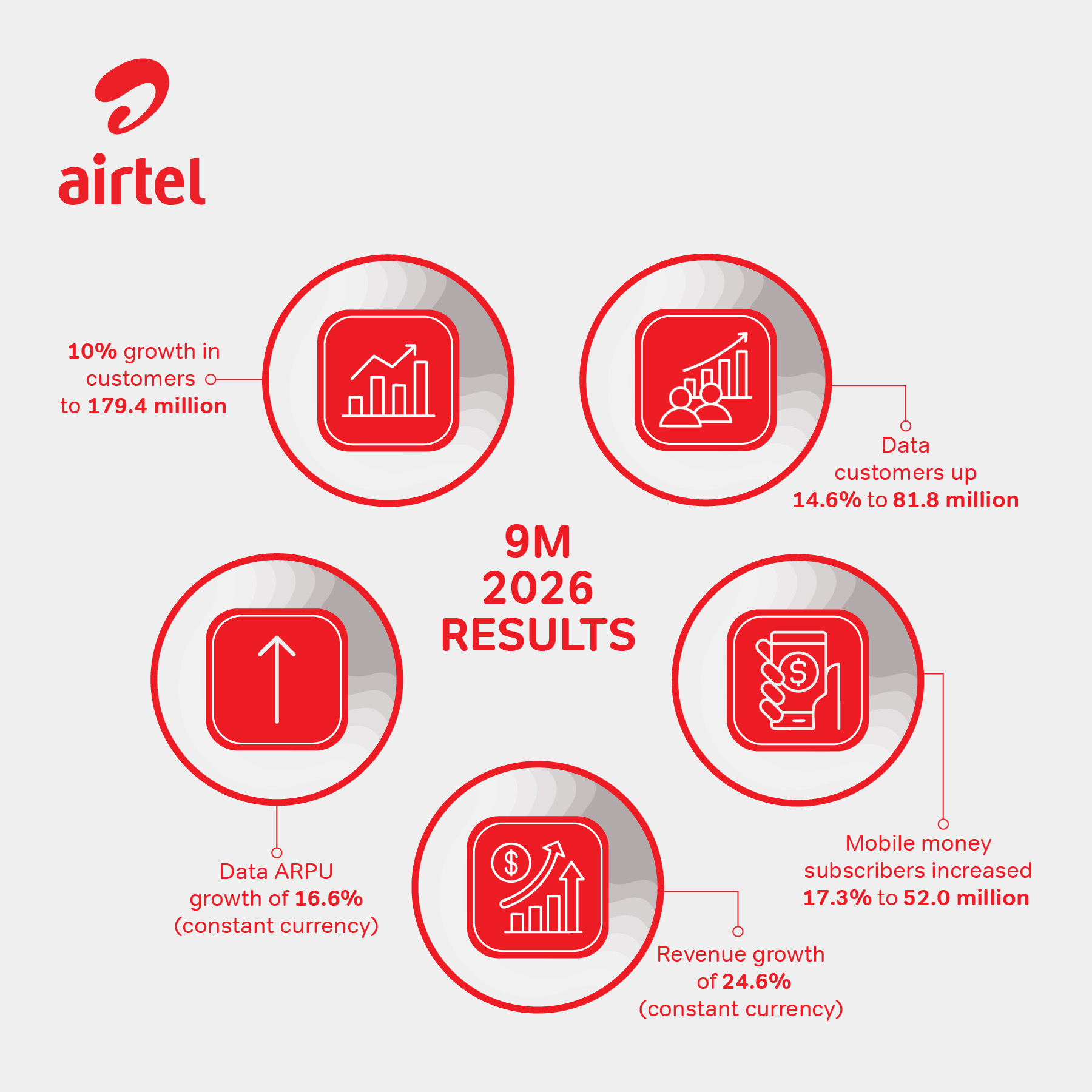

* Total customer base grew 10% to 179.4 million, with data customers up 14.6% to 81.8 million and smartphone penetration rising to 48.1%

* Airtel Money customers reached 52 million, surpassing the 50 million milestone, while annualised processed value exceeded US$210 billion

* Group revenue rose 28.3% to US$4.67 billion (24.6% constant currency), EBITDA increased 35.9% to US$2.28 billion and profit after tax more than doubled to US$586 million

By Duncan Mlanjira

Airtel Africa Plc has published its results for the nine‑month period ended December 31, 2025, reporting another quarter of strong operational and financial momentum across the Group.

Advertisement

In a press release, the highlights of the performance include total customer base growing by 10% to 179.4 million, with data customers up 14.6% to 81.8 million and smartphone penetration rising to 48.1%.

Mobile money customers reached 52 million, surpassing the 50 million milestone, while annualised processed value exceeded US$210 billion.

Group revenue rose by 28.3% to US$4.67 billion (24.6% constant currency), earnings before interest, tax, depreciation and amortization (EBITDA) increased 35.9% to US$2.28 billion and profit after tax more than doubled to US$586 million.

On network investments, the company reports that it rolled out ~2,500 new sites and expanded fiber by 4,000km, supporting enhanced capacity and customer experience.

In his remarks, Airtel Africa Chief Executive Officer, Sunil Taldar, says the results highlight the strength of the Group’s strategy, with strong operating and financial trends across the business.

CEO Sunil Taldar

“During the quarter, we accelerated investment to enhance coverage and data capacity while also expanding our fibre network,” he is quoted as saying in the statement. “Coupling this investment with innovative partnerships, strengthens our customer proposition and positions us to capture the considerable growth opportunity across our markets.

“Digitisation, technology innovation and embedding AI in our processes will also optimise the customer experience with increased digital offerings and closer integration of GSM and Airtel Money services allowing us to unlock the strong demand across our markets.

“Smartphone adoption continues to increase with penetration of 48.1%, and we are seeing solid progress in the development of our home broadband business, reflecting the need for reliable, high-speed connectivity across our markets.

“Our push to enhance financial inclusion across the continent continues to gain momentum with our Mobile Money customer base expanding to 52 million, surpassing the 50 million milestone.

“Annualised total processed value of over US$210 billion in Q3’26 underscores the depth of our merchants, agents and partner ecosystem, and remains a key player in driving improved access to financial services across Africa,” says the CEO, who pledged that the company remains on track for the listing of Airtel Money in the first half of 2026.

Advertisement

On the EBITDA performance, Taldar says “disciplined execution on cost efficiency, alongside accelerating revenue growth has enabled another sequential improvement — underpinning constant currency EBITDA growth of 31% — and we remain focussed on driving further incremental margin improvements”.

“Our strategic priorities remain clear: to keep investing in bestinclass connectivity, accelerate financial inclusion through our mobile money platform and deliver a great customer experience.

“These results reinforce our confidence in the longterm potential of our markets and our ability to create value for all our stakeholders.”

On the higher profit after tax in the period under review, the company reports that this was driven by higher operating profit and derivative and foreign exchange gains of US$99 million, as compared to US$153 million derivative and foreign exchange losses in the prior period.

On capital allocation, Airtel Africa reports that given the significant opportunity across its markets in 14 countries, the Group has accelerated its investment in-line with its revised capex guidance as it previously communicated.

“Capex of US$603 million increased by 32.2% over the prior period as we rolled out approximately 2,500 new sites and expanded our fibre network by approximately 4,000kms to 81,500+ km to enhance both coverage and capacity — supporting a strong customer experience.

“Overall population coverage has reached 81.7% — an increase of 0.6% from a year ago. Leverage has improved from 2.4x to 1.9x, with lease-adjusted leverage also improving to 0.7x from 1.1x a year ago, primarily driven by the improvement in EBITDA.”

Advertisement